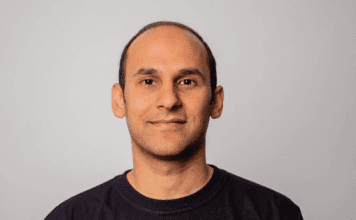

Nadeem Anjarwalla, one of the two Binance executives being held in Nigeria on charges of tax evasion and other offenses, has allegedly escaped from government custody.

In keeping with the ongoing Ramadan fast, Anjarwalla, 38, escaped from the Abuja guest home on Friday, March 22, 2024, according to a report by the online publication PremiumTimes. He and his companion were being held there when he was brought by the on-duty guards to a nearby mosque for prayers.

Anjarwalla, who is also a citizen of Kenya, is thought to have flown out of Abuja using a Middle East airliner, an immigration official informed PremiumTimes when asked how he managed to leave.

“Binance executive fled Nigeria on a Kenyan passport as authorities are trying to determine how he obtained the passport, given that he had no other travel document (apart from the British passport) on him when he was taken into custody,” the source said.

The suspect was detained at a “comfortable guest house,” according to another source who spoke with the newspaper. The suspect was granted numerous privileges, including the use of cellphones, which Anjarwalla is thought to have taken use of in order to plan his escape.

In response to a Sunday night inquiry regarding the Binance executive’s escape from custody, Zakari Mijinyawa, Head of Strategic Communication at the Office of the National Security Adviser (ONSA), promised to look into the matter and get back to us. As at the moment this report was submitted, he had not yet done so.

In Abuja, a Magistrate Court received a criminal complaint against the two executives. An order to remand the two for a period of fourteen days was given by the court on February 28, 2024, to the Economic and Financial Crimes Commission (EFCC). The data/information of Nigerian traders on Binance’s platform was also mandated by the court to be given to the Nigerian authorities.

The executives’ remand was extended by the court for a further 14 days in order to stop them from tampering with evidence after Binance disobeyed the order. The case was then postponed by the court until April 4, 2024.

Additionally, on March 22, the Nigerian government filed a formal complaint with the Federal High Court in Abuja, accusing Binance Holdings Limited, Anjarwalla, and Gambaryan of violating Section 8 of the Value Added Tax Act of 1993 (as amended) by offering services to subscribers on their platform without registering with the Federal Inland Revenue Service (FIRS) and failing to pay all applicable taxes administered by the service.

Furthermore, the defendants were charged with violating S.29 of the Value Added Tax Act of 1993 (as amended) by providing taxable services to subscribers on their trading platform without sending them invoices so they could calculate and pay their value-added taxes.

In accordance with Count Three of the charges, the three defendants were charged with violating Section 40 of the Federal Inland Revenue Service Establishment Act 2007 (as amended) by providing services to users on their Binance trading platform for the purchase, sale, and transfer of cryptocurrency assets, as well as failing to deduct the required Value Added Taxes from their operations.

The final count of the charges seeks punishment for the defendants for allegedly encouraging users of their Binance trading platform to illegally withhold taxes or fail to pay them, thereby committing an offense against the provisions of S.94 of the Companies Income Tax Act (as amended).