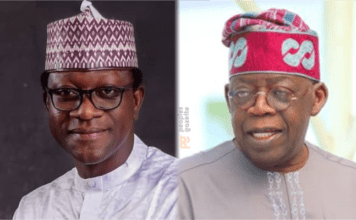

Abdulmumin Jibrin, a federal lawmaker representing Kiru/Bebeji Federal Constituency in Kano State,, has showed strong support for President Bola Tinubu’s proposed tax reform bills, saying they would help optimise Nigeria’s fiscal policies and revenue collection.

He also disclosed that Zacch Adedeji, the Chairman of the Federal Inland Revenue Service, was aggressively pushing the bills.

The former chairman of the House Committee on Finance endorsed the tax reform bills when he appeared as a guest on Sunday’s edition of Channels Television’s Politics Today.

Jibrin was formerly the Director-General of the Tinubu Support Group until he left the All Progressives Congress to join the New Nigeria People’s Party in 2022.

His clarification comes four days after a former Chief Whip of the Senate, Ali Ndume, criticised the tax reform bills, stating they are “dead on arrival” in the National Assembly.

His comments came amid widespread opposition to the proposed increases in Value Added Tax and other tax measures.

Jibrin insisted that anyone who thoroughly reads the bills, as he has, would understand that if passed, they would streamline and enhance revenue generation and fiscal policies in the country.

He said, “I have read the bills. And I tell people these are issues we have promoted over the last 15 years in the National Assembly. As Chairman of the House Committee on Finance, we pressed hard to consolidate our revenue collections.

“So, this is not the idea of the young man currently serving as the Chairman of the Federal Inland Revenue Service (Zacch Adedeji), who is being portrayed as the one pushing for it. If Nigerians look back, they will see that these are issues we have consistently pushed to strengthen our revenue system and fiscal policies to optimise revenue collection.

“What bothers me is that, when you raise this kind of issue, you are not taking money away from anyone. After all, the money belongs to the country. All we are saying is that we should streamline it so that everyone can see how this money is coming in a much tidier manner.”